This guide was analyzed by Serge, MSc. As a business owner and researcher, I look for the logic and facts behind the advice I share. I focus on practical tips and recommend tools and ideas I believe to work, helping you find what actually works for your progress.

Ever thought about making your money work for you?

Not just saving it, but actually growing it?

That’s exactly what investing is all about. If you’ve been curious about the stock market but felt overwhelmed, don’t worry, you’re not alone. Even If you’ve never bought stocks, you can start figuring it out today.

Why investing can make a difference

Let’s start simple. Saving money is good, but inflation eats away at it. That means what you have today buys less tomorrow. Investing helps your money grow faster than inflation, so you don’t just protect your cash, you increase it. Even small steps now can turn into something big over time.

Think about it this way: putting your money in the bank is safe, sure, but if you want real growth, you need to make it work. Stocks, ETFs, and other investments can do that for you, but only if you understand how they work.

Getting ready to invest

Before you dive in, take a moment to plan. Many beginners jump in without goals and end up confused or losing money.

Step 1: figure out your financial goals. Do you want extra income, long-term growth, or just learn how to trade?

Step 2: make a basic plan. Know how much you can invest safely and what you want to achieve.

This guide walks you through all of that. It’s designed to give you confidence so you don’t feel lost when you take your first steps in investing.

Understanding risk and reward

Risk and reward go hand in hand. Higher returns often come with higher risk. But if you understand how it works, you can manage that risk. Time is your friend here. The longer you invest, the more you can ride out market ups and downs.

So don’t panic when the market wobbles. The key is to think long-term and make smart choices.

Stock market basics

The stock market can feel like a maze at first. There are exchanges, brokers, and different types of stocks. But it’s not as complicated as it seems. You don’t have to know everything at once.

Start by learning the basics, what stocks are, how they’re traded, and why companies issue them.Once you understand that, it’s easier to make smart decisions about what to buy and when.

Different Types of Stocks

Not all stocks are alike. You’ve got growth stocks , these can shoot up fast, but yeah, they’re riskier. Then there are value stocks. Slower movers, steadier, less dramatic. Honestly, knowing which suits you is all about your comfort with risk and what you want to achieve.

Oh, and don’t let stock splits or fractional shares freak you out. They might look confusing, but once you get them, they’re actually pretty handy. Think of it like splitting a pizza into smaller slices, same total, more flexibility.

Checking Out Stocks

Charts, reports, numbers… sounds boring, right? But trust me, they tell a story. You’ll see which stocks have potential, which ones are shaky.

Technical stuff, fundamentals, basically ways to read the health of a company. Don’t try to memorize everything. Pick a few things, learn a little each day, and it starts making sense.

Making a Simple Plan

You need a plan, even a small one.

How much money will you invest?

Which types of stocks fit your style?

When will you check your portfolio?

Don’t just jump on tips you see online. A plan keeps you on track and stops you from making dumb mistakes.

Quick Tips

Keep learning — markets shift all the time.

Diversify — don’t dump all your cash in one stock.

Set limits — know your risk level, stick to it.

Track your investments — check how they’re doing.

Investing might feel scary at first. But starting small, learning as you go, and staying consistent works. Eventually, you’ll see results.

This guidebook helps you start confidently. Take that first step, your financial freedom is waiting.

What You’ll Learn. Chapter by Chapter

CHAPTER 1: Why Is It Important to Invest?

Ever wondered why people invest their money instead of just saving it? This chapter explains how inflation works, how it slowly reduces your money’s value, and why investing helps you stay ahead. You’ll also see simple examples comparing saving and investing so you can understand where your money grows best.

CHAPTER 2: What You Should Do Before Investing

Many beginners rush into investing without a plan. This chapter helps you avoid that mistake. You’ll learn how to set clear goals, build the right mindset, and create a simple plan before you start. By the end, you’ll feel prepared and confident to take your first step.

CHAPTER 3: Time, Risk, and Return

Here’s where things start to make sense. You’ll learn how time affects your results and why risk and reward are always connected. The chapter also shows how different investing timelines can change your outcome — and how patience can help you get better returns.

Grab your copy of Road to Successful Investing and start building a smarter portfolio today!

CHAPTER 4: Stock Market Basics

This chapter breaks down what the stock market really is and how it works. You’ll learn what stocks are, how they’re traded, and why companies sell them. It’s simple and easy to follow, even if you’re brand new to investing.

CHAPTER 5: Understanding Securities

Stocks, bonds, and ETFs — these are called securities. You’ll learn what each one means, how they differ, and which types might fit your personal goals and comfort level.

CHAPTER 6: Why Stock Prices Go Up and Down

Ever wondered why stock prices change so much? This chapter explains what causes those moves — from company performance to market news and global events. You’ll start to understand what’s really behind the ups and downs.

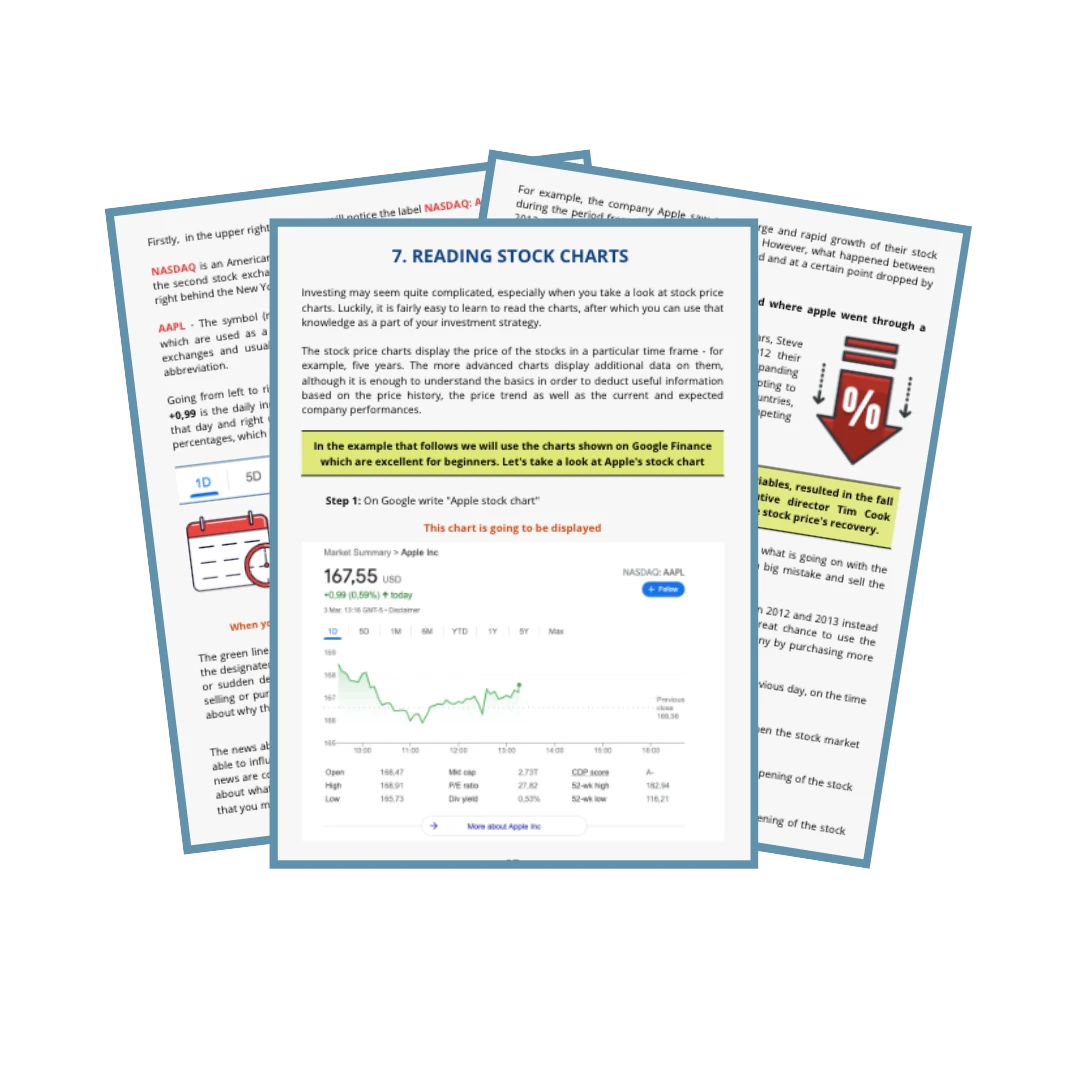

CHAPTER 7: Reading Stock Charts and Statistics

Charts and numbers can look confusing at first, but once you know what to look for, they tell a clear story. This chapter teaches you how to read basic stock charts and key statistics that help you make smarter choices.

Grab your copy of Road to Successful Investing and start building a smarter portfolio today!

CHAPTER 8: Growth and Value Stocks

Not all stocks are the same. Some grow fast but are riskier, while others move slowly but more steadily. This chapter helps you understand the difference and choose what suits your investing style.

CHAPTER 9: Stock Splits

Stock splits might sound complicated, but they’re actually simple. You’ll learn why companies split their stocks, how it affects the price, and what it means for you as an investor.

CHAPTER 10: Stock Analysis Methods

You’ll learn about two main ways investors study stocks, technical and fundamental analysis. Both help you figure out which companies are worth investing in and which to avoid.

CHAPTER 11: Bull and Bear Markets

Markets always go through ups and downs. This chapter helps you understand both bull (up) and bear (down) markets, and how to stay calm when prices change. You’ll learn how to make smart moves in any market.

Grab your copy of Road to Successful Investing and start building a smarter portfolio today!

CHAPTER 12: Investment Strategies

Everyone needs a plan. This chapter walks you through simple, practical strategies to build your portfolio. You’ll learn how to balance your risk, set goals, and make consistent progress.

CHAPTER 13: Stock Market Events and Timing the Market

Some people try to guess when to buy or sell, that’s called timing the market. This chapter explains why it’s tricky and shows better ways to make steady progress no matter what’s happening in the economy.

CHAPTER 14: The Influence of Social Media on Investing

Social media can make investing look easy or exciting, but it can also be misleading. You’ll learn how online trends and hype can affect stock prices, and how to think carefully before following them.

CHAPTER 15: Buying Stocks

Now it’s time to take action. This final chapter walks you through how to actually buy your first stocks, from picking a reliable platform to placing your first trade. Simple, clear, and step-by-step.

Grab your copy of Road to Successful Investing and start building a smarter portfolio today!